Advertised Senior Roles in Nonprofit Sector Rise 55% in Q1 2021

2into3’s Quarterly Recruitment Monitor for the first quarter of 2021 shows the number of senior roles advertised within the nonprofit sector continues to increase, year on year.

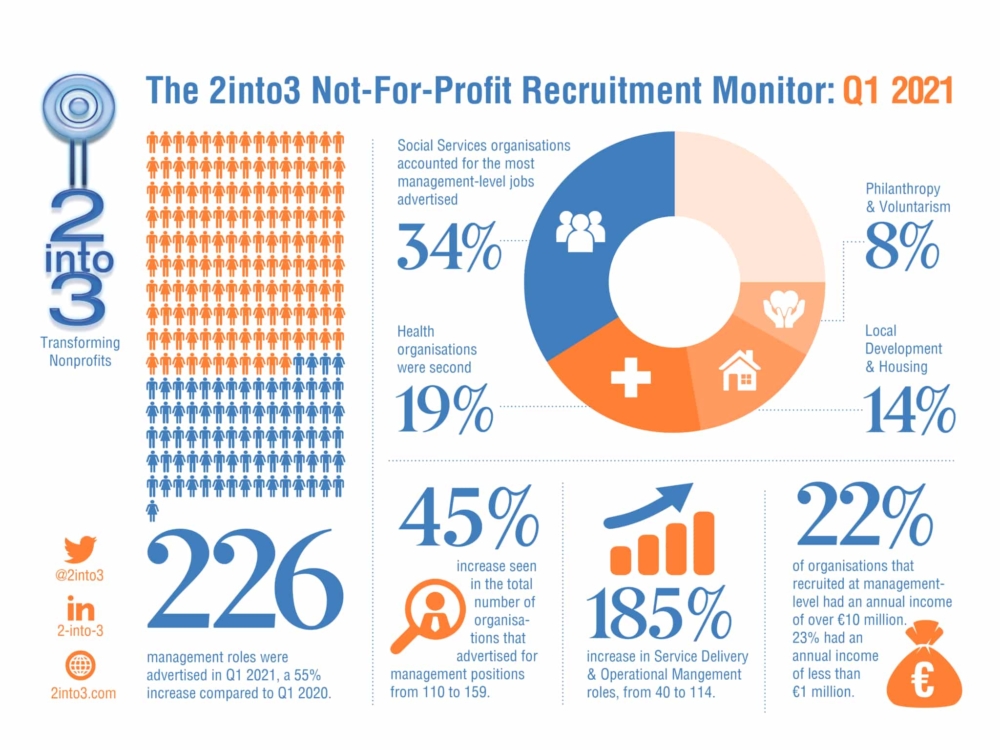

Our snapshot of data shows that in Q1 2021, a total of 226 senior roles were advertised, up almost 55% on the same quarter last year (146 roles). The number of organisations recruiting increased by 45%, from 110 to 159.

While the pandemic would only have impacted the last 4 weeks of Q1 2020, it has made a comparison between 2020 and 2021 somewhat difficult. It is unlikely that demand for senior nonprofit professionals has increased by this amount when comparing these time periods; a more likely explanation would be a concentration of demand for staff in the last three months, carried-over from mid to late 2020, when recruitment may have been put on hold.

By Sub-Sector

Social Services organisations continue to advertise the greatest share of the roles (34%), followed by Health (19%), Local Development & Housing (14%) and Philanthropy & Voluntarism (8%). These four sub-sectors alone account for over three-quarters of all roles recorded by 2into3 in Q1 2021.

The big change here is in the Philanthropy & Voluntarism sub-sector, which previously accounted for just 2.7% of roles in Q1 2020 is now 8%. Declines were seen in roles within the International (6%, down from 11%) and Education and Research (3%, down from 12%) sub-sectors.

By Role type

CEO level roles, as a share of all senior positions advertised, fell from 15% in Q1 2020 to 8% in Q1 2021. There was also a reduction in the number of roles advertised in Administration, Strategy & Governance (down 54%) and HR (down 29%).

While senior Fundraising roles rose in number (42 up to 48) their share within all roles fell from 29% to 21%. Service, Delivery & Operations roles jumped a massive 185%, from 40 to 114 roles, and accounted for just over half of all senior roles recorded. This may be a reflection of activity in the sector, as organisations scale up to meet the extra demands COVID-19 has placed on their services.

Advertised Communications & Marketing roles doubled (from 7 to 14) and Finance roles decreased in their overall share, but in absolute terms increased by one-third, year-on-year.

What does this mean?

What does this snapshot of activity tell us about the Irish nonprofit sector as we continue our return to normality? It shows that there is still a demand for senior talent within the sector, although the skills and experience that are in demand would appear to be shifting.

Whether these trends continue or whether they are a short-term response to the pandemic remains to be seen. We present this data with the full knowledge that year-on-year comparisons in the middle of a once in a century event are to be taken with a health warning.

If our own experience in 2into3 is to be factored-in, the strong, active demand for talent is being balanced against a more passive supply side where candidates appear to be less active in searching for a career move, but are often interested, if they are approached and made aware of what is on offer. The candidates are out there – they just might be a bit harder to find right now.